Laura, the CEO of Company A, offers credit sales to her customers.

#Ar turnover ratio definition how to

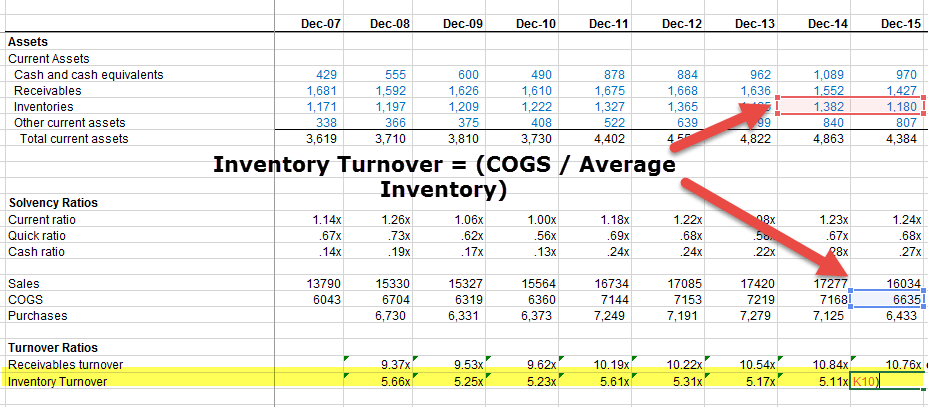

Let’s take an example to understand how to calculate the accounts receivable turnover ratio. Divide the net credit sales by the average accounts receivable to get the accounts receivable turnover ratio.Ī Sample Calculation of Accounts Receivable Ratio.Determine the average accounts receivable by adding the beginning and ending accounts receivable for a set period and dividing by 2.Īverage Accounts Receivable Formula = (Beginning AR + Ending AR) ÷ 2.Net Sales Formula = Gross Sales – Refunds/Returns – Sales on Credit Calculate the net credit sales by subtracting returns and sales allowances from gross sales.FormulaĪccounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable Steps to calculate: This ratio is used to measure how well a company can collect its debt and manage its customer credit. To calculate the accounts receivable turnover ratio, you need to divide the net credit sales by the average accounts receivable. By analyzing the ratio over time, businesses can identify trends and make adjustments to their collections process. By analyzing the ratio for individual customers, businesses can identify those who are slow to pay or may have difficulty paying.īetter Decision-Making: It provides valuable information that helps businesses make better decisions. This leads to better cash flow management and improved financial health.Ĭustomer Creditworthiness: It also helps businesses assess customer creditworthiness. Improved Financial Health: It indicates if a business is collecting its outstanding accounts receivables quickly. By monitoring this ratio regularly, businesses can identify trends, make better decisions, and optimize their cash flow.

Here are some reasons why the accounts receivable turnover ratio deserves your attention:īetter Cash Flow Management: It provides insights into how quickly a business can collect its outstanding accounts receivables. It is a crucial metric that helps businesses optimize their cash flow management. The importance of the accounts receivable turnover ratio cannot be overstated. Why Is It Crucial to Measure Accounts Receivable Turnover Ratio? The ratio indicates how quickly a business can collect its outstanding accounts receivables over a given period. Businesses use it to monitor and optimize their cash flow. Accounts Receivable Turnover Ratio is a key metric that measures how efficiently a business can convert its credit sales into cash.

0 kommentar(er)

0 kommentar(er)